BREAKING CONCENTRATION

A classic analogy for the relationship between hazard and risk is that of a person swimming in shark infested waters. The hazard is the shark with its razor teeth and underwater prowess.

The person willing to get into the water exposes themselves to the shark, creating the risk of being killed or injured in an attack, all the ramifications thereof.

Post attack, we analyze. Did the person realize there were sharks in the water? Or perhaps, they overestimated their swimming skills? Did they choose the risk or were they ignorant of it?

The shark lurking in your portfolio is excessive concentration of a single stock or holding. Most often it’s your company stock. It may not look scary, but it can hurt you. It’s important you’re not ignorant of it.

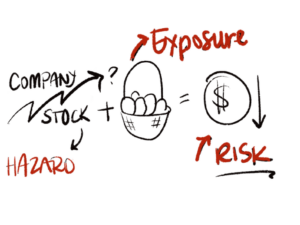

If concentrated stock is the hazard, then the exposure is failing to diversify your portfolio. The risk? A decline of that stock’s value which can have disastrous effects to your overall success.

Let’s say you’ve got a lot of company stock in your 401k or other employer benefit plan. It’s been doing great for a long time, and you want to hold it to watch it soar like an eagle!

If you walk into our offices, we’re probably going to recommend that you sell all or part of it. Why? It’s been doing so great for so long! It’s because of Memaw.

The value of your employer’s stock depends on their financial health. If you rely too heavily on it, you create concentration risk. Memaw said you don’t put all your eggs in one basket for a reason. If it falls or breaks, that’s it. No breakfast for a while.

This exact scenario has played out several times in the decade plus I’ve been at The Advocates. Clients have lots of company stock and are convinced, in good markets, that it will continue to rise, and so refuse to sell all or even part of their stock. Once, the stock lost half it’s value about a year after our advisor recommended the sale.

Our clients are exceptionally smart people but that hasn’t always stopped them from ignoring sound advice and continuing with a high-risk position. Why, you ask?

There’s little variance in the reason. These are emotional decisions born out of good qualities like optimism and loyalty, but lacking objectivity, clients have inadvertently damaged their financial plans. That’s why diversification is critical, and we will continue to harp on it as long as anyone is willing to listen.

In chapter 6 of his book The Psychology of Money, Morgan Housel offers an interesting example. Entitled Tails, You Win, it tells the story of a wildly successful art dealer who sold part of his long-held collection for more than €100 million.

It seemed like prescience that he was able to select works from so many future masters, creating such a valuable collection. How did he manage to pick so many winners? He didn’t, at least not the way you think.

Housel says that successful art investors like this guy buy large quantities of art, and only a few become winners. Those few pieces are tails, high-performing, freaky outlier holdings that compensate for purchases that turn out to be less successful.

Good art dealers operate like index funds. A few “tail” holdings whether in your art or investment portfolio can contribute the majority of the returns, but only if you’re diversified enough to increase your odds of holding them. The result of this can seem like magic, but it’s really just solid investing principles.

Diversification is risk mitigation. But it’s also potential for growth. Viewed in that light, perhaps more people would be willing to partake and ditch some of that company stock. Sound advice if you’re willing to take it.