STRATEGIC GIVING SAVES ONE CLIENT SIX FIGURES IN TAXES

Just like last week’s QCD illustration, this one too is based on a real fact pattern for a real client with a real outcome. You should discuss the facts of your situation with your advisor.

Sending Less to the IRS

The clients in today’s illustration were long tenured with a large oil and gas company before they decided to retire. One of them had over $250,000 in company stock with a low basis of only $8,500 in their 401(k) plan, all pre-tax money.

Sounds like they’re about to pay a lot of taxes! Read on to see how we were able to save them big tax dollars with a smart alternative to the traditional 401(k) rollout. But first, let’s look at the facts of their case:

Key Facts

Their retirement comes with a nice pay package that’ll put the couple in the top marginal tax bracket. That means 37% at retirement, but they’ll be in the 24% bracket for the foreseeable future thereafter.

They have no mortgage.

The give large amounts to charity every year and, because of their retirement income, they want to give $100,000 now.

Reducing Their Tax Burden

Our advisors were able to help our client take advantage of a technique called Net Unrealized Appreciation (NUA). Here’s how it works:

Our client makes a large charitable donation of $250,000 now. That covers the $100,000 they want to give upfront along with all charitable giving for the next 6 years at $25,000 annually.

We transfer all their low basis company stock “in kind” from the 401(k) to an after-tax brokerage account. The charitable donation is made from this account.

Per NUA rules, our client pays ordinary income tax on the $8,500 basis. The difference versus the stock’s current value becomes long term capital gain.

All other pre-tax 401(k) money rolls into an IRA with no tax consequences.

The Impact

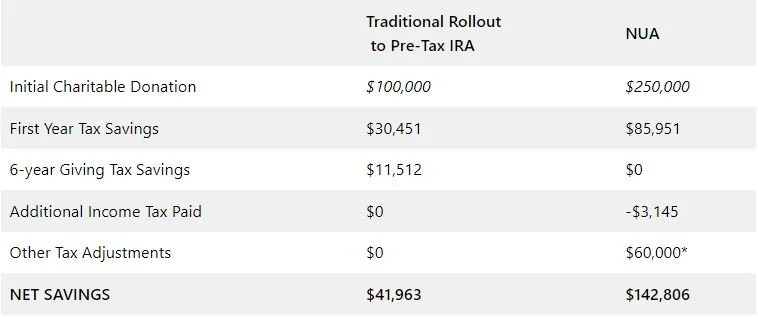

The following table shows what NUA was able to save our client versus the traditional 401(k) rollout with annual charitable giving over a six-year period.

That’s a difference of $100,843 in tax savings, and our client will never pay capital gains on the appreciated stock they donated.

Look at it this way: the traditional scenario would have saved our client around $42,000 in taxes creating a net “cost” for the company stock of about $208,000.

Taking advantage of NUA saved our client $142,806 for a net “cost” of $107,194, creating the $100k+ savings you see above. That’s a lot money more in their pockets and not in the IRS coffers.

Not everyone will be able to take advantage of NUA, but for those who fit the criteria, there are potentially huge savings to be had.

*If our clients had taken the traditional route, they would have paid income tax on every withdrawal of that $250,000. Because the stock was donated “in kind” those taxes are GONE. That’s a tax savings of $60,000.